“I’ve barely got any money left by the 15th of the month,” is a common statement. As a result, they find it difficult to pay for their essential costs and might even need to borrow money from savings or take on more debt in order to survive.

You can better manage your finances by making and adhering to a budget that follows the 50-30-20 rule in order to prevent this scenario. By adhering to this guideline, you can make sure you have adequate cash on hand to pay for necessities, indulge in occasional luxury spending, and put money down for the future. Let’s decode the 50-30-20 rule to see what it means.

Understanding the Regulation

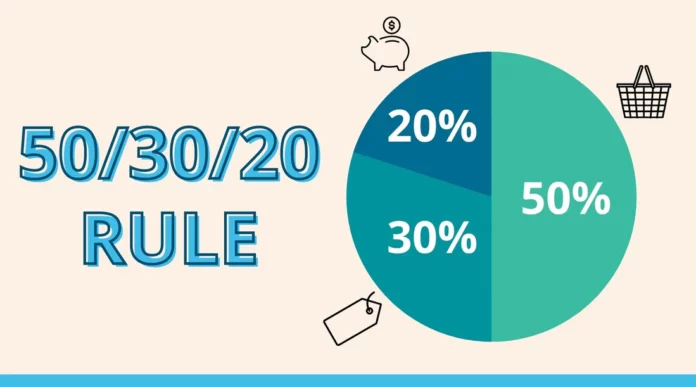

According to the 50-30-20 rule, you should divide your income into three main categories: savings, wants, and needs.

According to the 50-30-20 rule, you should save 20% of your income for debt repayment or future goals, spend 30% on discretionary wants, and spend 50% of your income on necessities. You can balance your spending, lead a healthy lifestyle, and meet your long-term financial objectives with the aid of a 50-30-20 budget.

Read also: 7 Best Small Investment Plans Ideas for Students in India, 2023

Disrupting the 50-30-20 Ratio

Needs: 50%

According to the 50-30-20 rule, the 50% allotment for needs relates to the costs necessary for a person’s survival and well-being. These costs should be given top priority because they are essential to your everyday survival. Here are a few instances of needs that fit into the 50% range.

1.Housing: This includes your rent or mortgage payment, property taxes, homeowners insurance, and any necessary repairs or maintenance.

2.Utilities: It includes paying for electricity, gas, water, and other utilities to keep your home running.

3.Food: To buy groceries and other household items like toiletries and cleaning supplies.

4.Transportation: This includes your car payment or public transportation expenses, as well as gas, maintenance, and insurance costs.

5.Health care: Paying for health insurance premiums, co-pays, and deductibles, as well as prescription medications and other health-related expenses.

6.Basic clothing: To buy appropriate clothes for work, school, or other activities.

7.Childcare: If you have children, you may spend on daycare or other childcare expenses.

8.Personal finance: This includes expenses such as debt payments, taxes, and insurance.

Setting priorities for your needs and making sure you have the funds to meet them are crucial. It might be necessary in some circumstances to spend less on necessities. You could downsize your dining out budget, transfer to a less expensive form of transportation, or relocate to a more reasonably priced neighborhood. To obtain a better deal, haggle with service providers is an additional choice.

It’s crucial to keep track of your spending and make sure you don’t go overboard in this area. You can stay out of debt and make sure you have enough money for your essentials by keeping a balanced budget.

Wants: 30%

The 30% allotment for wants in the 50-30-20 rule refers to non-essential spending that can greatly enhance your quality of life but is not necessary for survival. These are a few instances of desires that fit into the 30% range.

1. Entertainment: This includes going to movies, concerts, or sporting events, as well as streaming services like Netflix or Hulu.

2. Dining out: You can spend money eating at restaurants, cafes, or fast-food outlets or order takeout or delivery.

3. Travel: You can use your money to plan vacations, trips, or weekend getaways.

4. Hobbies: You can pursue your interests or hobbies by buying equipment or paying for classes or lessons.

5. Shopping: You can buy clothes, electronics, gadgets, or other items you desire but don’t necessarily need.

6. Gifts: You can spend money on buying gifts for your friends, family, or loved ones.

7. Home decor: You can use your money to decorate your home, buy furniture, or upgrade appliances.

8. Personal grooming: It includes expenses such as haircuts, manicures, and facials.

It’s crucial to remember that wants aren’t always wasteful or superfluous spending. They can enhance your mental well-being, lower stress levels, and help you enjoy life more. It is simple to overspend in this area, though, and to forget about savings and necessities.

Spend money only on items that make you happy and fulfilled in order to prevent this. Prioritize your wants. Managing your desires can be achieved by following these tips.

Establish a budget: Set a monthly budget for the amount you can spend on wants. It can assist you in setting spending priorities and preventing overspending.

Look for less expensive options: There are inexpensive options available for shopping, entertainment, and eating out, like happy hour specials, coupon codes, and free events.

Emphasize experiences over things: Rather than spending a lot of money on material goods, think about investing in memorable experiences like traveling or going to concerts or events.

Avoid impulse purchases: Before making a purchase, consider if you need it and if it fits your budget.

Keep tabs on your expenses: Keep tabs on your expenses:Maintain a log of your spending and check it frequently to make sure you don’t go overboard and stick to your spending limit.

Read also: 5 common excuses people make to put off investing and how to overcome them

Savings: 20%

According to the 50-30-20 rule, saving 20% of your income is crucial to reaching your financial objectives, which include paying off debt, setting up an emergency fund, and making long-term investments. These are a few instances of savings that meet the 20% threshold.

1.Emergency fund: It’s critical to have savings set aside for unforeseen costs like auto repairs, medical bills, and job loss. Experts advise setting up a reserve of three to six months’ worth of expenses at minimum.

2.Retirement savings: To put money aside for the future, you can fund an IRA, 401(k), or other retirement account. Early retirement savings and consistent contributions are essential to maximize compound interest.

3.Debt repayment: You can use your savings to pay off any outstanding debts, such as student loans or credit cards, more quickly and with less interest.

4.Short-term goals: You can save for short-term goals such as a down payment on an apartment, a car purchase, or a vacation.

5.Long-term objectives: You can set aside money for long-term objectives like launching a business, covering your child’s college expenses, or purchasing a second residence.

6.Investment: You can invest your savings in stocks, mutual funds, or other financial instruments to earn higher returns than traditional savings accounts.

7.Tax payments: You can pay your property or income taxes with the money you have saved.

On the other hand, this area is frequently disregarded despite being crucial to long-term wealth accumulation and financial stability. Making your savings a priority and finding the right balance between short- and long-term goals are essential. Some tips for managing your savings wisely are provided below.

Read Also: Is a loan for education – the best option in India?

How to Apply the 50/30/20 Rule?

The 50-30-20 rule is a straightforward but useful budgeting principle that advocates preserving a sound financial equilibrium. The steps below can be used to apply the 50-30-20 rule.

● Step 1: Determine your income after taxes: In order to utilize the 50-30-20 rule, you must be aware of your net worth following taxes.

● Step 2: Assess your requirements: Determine how much you’ll need to spend on housing, utilities, groceries, transportation, and medical care. They ought to account for half of your earnings.

● Step 3: Determine your wants: Calculate your discretionary expenses such as dining out, entertainment, hobbies, and vacations. These expenses you enjoy but are not necessary for survival and should take up 30% of your income.

● Step 4: Determine your savings: Set aside 20% of your take-home pay for savings. It covers investments, debt repayment, emergency savings, retirement savings, and both short- and long-term financial objectives.

● Step 5: Monitor your spending:Following the process of creating a budget, it is critical to keep an eye on your expenditures and make sure you are staying within it. To keep tabs on your spending, you can use spreadsheets, budgeting apps, or pen and paper..

● Step 6: Adjust your budget: You might need to make adjustments to your budget to stay on track if you notice that you are going overboard in one area, like wants.

That being said, sticking to your spending plan, monitoring it, and making necessary adjustments are essential to following the 50-30-20 rule. You can control your financial future and achieve your objectives by being aware of your finances and applying a proactive financial management strategy.

Read also: 10 financial planning rules to manage money in your life

Example of the 50/30/20 Rule of Thumb

The general 50/30/20 rule of thumb aids in achieving balance and stability in your finances. According to this rule, people ought to divide their post-tax income as follows:

1. 50% of the earnings should be used for essential expenses such as housing, utilities, groceries, transportation, and healthcare.

2. 30% of the income should be used for discretionary spending such as entertainment, dining out, and shopping.

3. 20% of the income should be saved or invested in long-term financial goals such as retirement, emergency fund, or debt repayment.

To illustrate this rule, let’s consider the example of Mr A, who earns a monthly income of Rs 40,000 after taxes. According to the 50/30/20 practice, Mr A, should allocate her earnings as follows.

1. 50% of her income, or Rs. 20,000, should go toward fundamental expenses such as rent, utilities, groceries, transportation, and healthcare.

2. 30% of her income, or Rs 12,000, can be used for discretionary spending such as dining out, entertainment, and shopping.

3. 20% of her income, or Rs. 8000, should be saved or invested for long-term financial goals such as retirement, emergency fund, or debt repayment.

Mr. A can make sure his living within his means, staying out of debt, and setting money aside for the future by enforcing this rule. In accordance with his financial objectives, priorities, and situation, he can further modify his spending and saving practices. He could, for instance, raise his savings rate to 25% or 30% and cut back on discretionary spending if he wanted to save more for retirement. However, he can temporarily raise his discretionary spending to 40% or 50% and modify his savings if he decides to take a trip or buy a new car.

Conclusion

The 50-30-20 budget can be a great tool to help you achieve financial stability and balance, whether you’re just starting out with financial planning or looking to improve your financial management skills.

The 50-30-20 rule also helps you reach your goals of debt repayment, retirement savings, and realizing your aspirations of home ownership or business startup. Additionally, you can maximize your investments and savings with the aid of platforms like 5paisa, which will make your money work harder.

Thus, put the 50-30-20 rule into practice right now to start down the path to reaching your financial goals!

Disclaimer: The article or blog or post (by whatever name) in this website is based on the writer’s personal views and interpretation of Act. The writer does not accept any liabilities for any loss or damage of any kind arising out of information and for any actions taken in reliance thereon.Also, www.finnbuzz.com and its members do not accept any liability, obligation or responsibility for author’s article and understanding of user.